Your own charge card use makes otherwise break your real estate loan recognition. Loan providers research not merely at the credit history as well as from the your debt-to-earnings ratio, which includes the new repayments on your handmade cards. Very improper the means to access your own credit cards makes they more complicated to obtain recognized for home financing.

Just like the handmade cards are rotating personal debt, you’ve got constant access to the financing traces, that may place your mortgage lender on the line whether or not it will get unmanageable. Here’s what lenders would like you to know about bank card utilize to switch your odds of home loan approval.

step 1. Usually do not Carry an equilibrium

Carrying a charge card equilibrium can cost you you more money since balance accrues appeal. Extremely credit card companies charges daily notice, which means your equilibrium develops each and every day if you do not pay it off.

Carrying a credit card equilibrium including shows that you use your mastercard to possess commands aside from what you are able manage. In the event the balance was large than the your own borrowing limit, they has an effect on your own borrowing utilization speed and you will credit rating.

So not merely does carrying credit cards balance charge a fee far more eventually, but it addittionally provides lenders a description to think you’re not economically in control.

It doesn’t mean you will never get approved when you yourself have people mastercard balance. Yet not, you should keep your own mastercard balances within what you could pay every month whenever possible to handle your bank account and you may to display lenders your a fair exposure when you get home financing.

What Loan providers Want you To understand

Simply fees everything you know you might repay you to day. For those who need costs something that you can not pay in full, create more the minimum fee. Such as for example, in case your furnace breaks and you can not afford to invest it of completely, break the bill to your 2 or 3 repayments to make it inexpensive if you’re paying the harmony regarding easily.

dos. Avoid using The Playing cards due to the fact an extension of the Earnings

Credit cards commonly an invite to invest what you need. Lenders however want you to stick to a budget. If you utilize handmade cards as an expansion of your own earnings, you end up within the credit card debt.

Not only will it reflect improperly for those who have a great deal out of personal credit card debt, but inaddition it grows the debt-to-income ratio. Per loan system have a max DTI might succeed. Your own DTI is sold with every monthly obligations on your credit history, including your minimum bank card payment. Excessive obligations can increase your DTI and then make your ineligible having an interest rate.

Exactly what Loan providers Want you To understand

If you fail to pay for a buy, cover it. Unless of course it is a crisis, don’t charge it if you don’t have the bucks to invest it well. Rather, find out a discount bundle so you can pay cash getting the object rather than set your self subsequent on the debt.

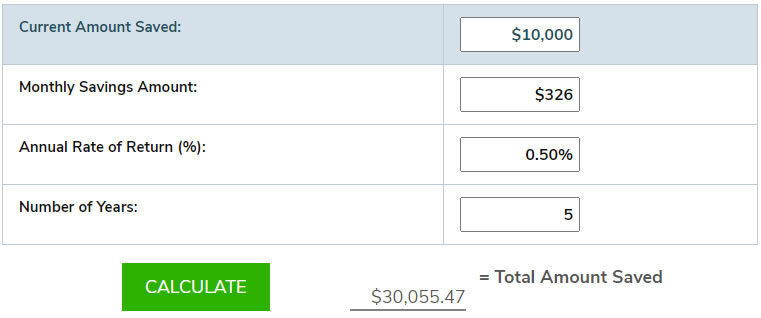

Once you make an application for a home loan, lenders dictate your debt-to-income ratio. If the DTI is higher since you generate a lot of commands, it might ask you for loan acceptance.

step 3. Check out their Credit card Use

Your mastercard usage procedures their full personal credit card debt since the a portion https://clickcashadvance.com/personal-loans-ky/ of your credit limit. Such as for example, when you have a $step 1,000 credit limit and you may a good $500 charge card equilibrium, you have a beneficial 50% borrowing usage price.

Your credit score reduces if your credit utilization rate rises beyond specific restrictions one disagree by borrowing bureau while the collection from consumers that you end up in (named a beneficial scorecard). Particularly, assume you are in a specific subset off consumers that was penalized if the their application was 30% or even more on a single of credit reporting agencies, circular into the nearby commission point. For every single $1,000 on your line of credit, never convey more than simply $295 an excellent. This does not mean you simply can’t use your charge card, however should only costs what you could afford to keep what you owe reduced.