Inside book

If you’re more 55, security release enables you to open some of the really worth inside the your property without the need to promote up-and move.

You’re taking aside a loan covered facing your home out-of an guarantee release supplier, that is up coming paid when you go into a lot of time-term worry otherwise perish.

Investigation throughout the Equity Release Council reveals that users reached ?2.six billion during the possessions money via collateral release items in 2023, since the number of new customers playing with security release rose so you’re able to 5,240 ranging from 12% higher than the last one-fourth.

However, taking out a collateral release plan is a big choice and you will there are disadvantages to take on, you need certainly to think carefully before-going to come.

What is actually collateral discharge?

If you’re a citizen aged 55 otherwise more mature, you might find that you’re domestic-rich however, bucks-terrible. Consequently you have more value tied on your family than simply you will do in the accessible cash and other Texas fast payday loans property.

Equity launch is actually an easy method to possess seniors to turn specific of one’s worth of their home to your bucks without the need to flow. It is fundamentally a certain type of loan which is safeguarded up against their possessions.

It is similar to home financing except you do not make constant, month-to-month repayments. Alternatively, people desire you owe try put into the loan and you can produces up-over go out. The loan was eventually paid down when you pass away otherwise transfer to long-identity worry.

Considering the means equity discharge performs, the interest money may cause the price of the loan so you’re able to balloon. Security discharge can expensive compared to the remortgaging or downsizing, having prices generally much higher than simply standard mortgage loans.

The amount of money are you willing to use?

The absolute most you could potentially obtain is to 60% of value of your property, according to the government’s Money Recommendations Solution.

Just how much can borrow utilizes activities just like your ages and also the worth of your property. The new commission generally speaking expands centered on your age when taking aside the merchandise.

- Your actual age

- How much cash you reside really worth

- The state of your quality of life

- You to definitely bucks lump sum

- Reduced, normal costs

- A mixture of one another

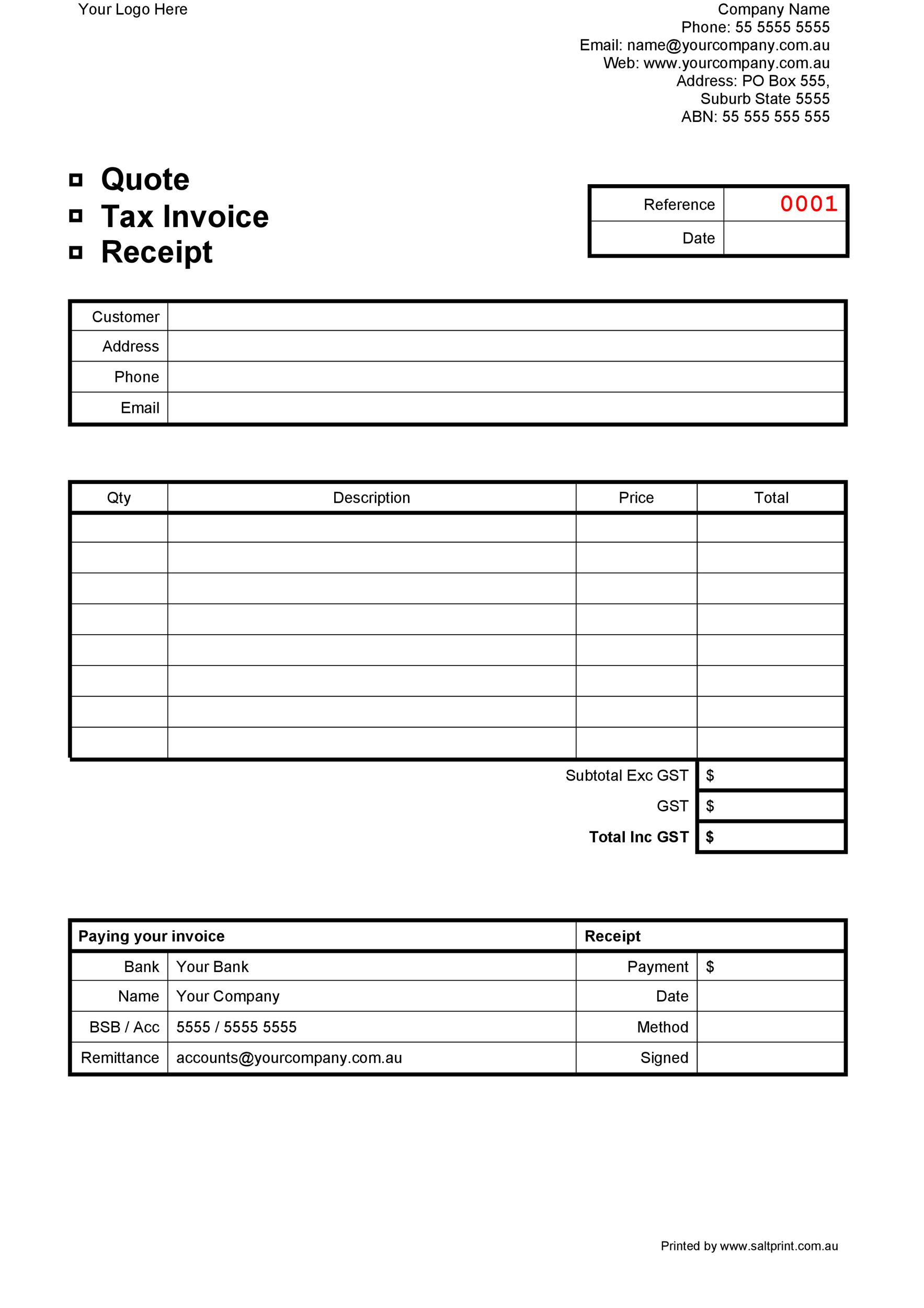

Collateral launch calculator

Make use of the free equity discharge calculator for instance the that below so you can score a sense of exactly how much you could potentially obtain.

How has actually interest rate changes influenced equity launch funds?

Years regarding rock bottom rates fuelled a guarantee discharge increase, that have individuals unlocking a record-breaking ?six.2 million of cash from their home during the 2022.

But not, the level of bucks put out compliment of collateral launch sank so you can ?dos.6 billion when you look at the 2023, pursuing the a few clear rises inside interest rates. This generated the cost of credit costly making the fresh new balance due on guarantee release arrangements balloon faster.

Into the Lender regarding The united kingdomt legs price shedding out of 5.25% so you can 5% when you look at the August, particular expect security launch pricing will start to slide gradually.

Rachel Springall, a funds specialist on , said: Economic conditions, rates of interest and you can field balance the enjoy its region in the event it comes to the new rates out of lifetime mortgage loans, just like the lenders must make sure it lay the pricing in-line with their attitude so you can chance.

The financial institution regarding The united kingdomt ft rates slash does dictate field sentiment resulted in the new re also-rates out-of life mortgages. Although not, loan providers could well be alert to any forecasts nearby the near future traditional interesting costs that could make sure they are think twice to shed costs by the famous margins.

Addititionally there is lingering uncertainty to if or not possessions costs will get fall in the future. Yet not, less than legislation implemented when you look at the 1991, products incorporate a no bad collateral be certain that, and therefore the fresh borrower will never are obligated to pay more the value of its property.