What is a property security mortgage?

A home collateral loan enables you to borrow a predetermined count, shielded by the collateral in your home, and you can receive your finances in one lump sum payment. Typically, family collateral financing has a predetermined interest rate, repaired name and repaired payment. Notice with the property guarantee mortgage is tax-deductible less than specific facts. Delight check with your income tax mentor to see if your be considered.

What exactly is a home loan refinance?

A home loan refinance allows you to receive a unique mortgage loan substitution your current financial. Sometimes when mortgage pricing are reduced, you’ll be able to believe a great re-finance to lessen your rates you was spending less cash across the lifetime of their home loan. You could prefer to stretch otherwise reduce your mortgage title along with your the latest loan depending on yours needs. You can also be able to need cash out of equity when you refinance to use for different aim along with do-it-yourself, debt consolidation, or paying for significant costs otherwise sales. Many conventional re-finance lenders charge closing costs once you refinance; although not, Find now offers financing that have no software charge and you may no cash owed on closing.

There are numerous differences when considering a property guarantee financing vs HELOC. Such as for example, property collateral loan is sold with repaired prices and you can a lump sum of cash while good HELOC is sold with variable costs and you can a credit line. Aside from that you like, each other a home security mortgage and you can HELOC might help fund biggest ideas such family home improvements.

The length of time does the borrowed funds procedure simply take?

The real period of time may vary because of the homeowner. When you get that loan that have Discover, we’re going to make certain that you might be up-to-date on the improvements and you can closure time along the way. Normally, the faster you could promote advice we request to confirm your own eligibility, this new faster we could circulate the loan file from the procedure.

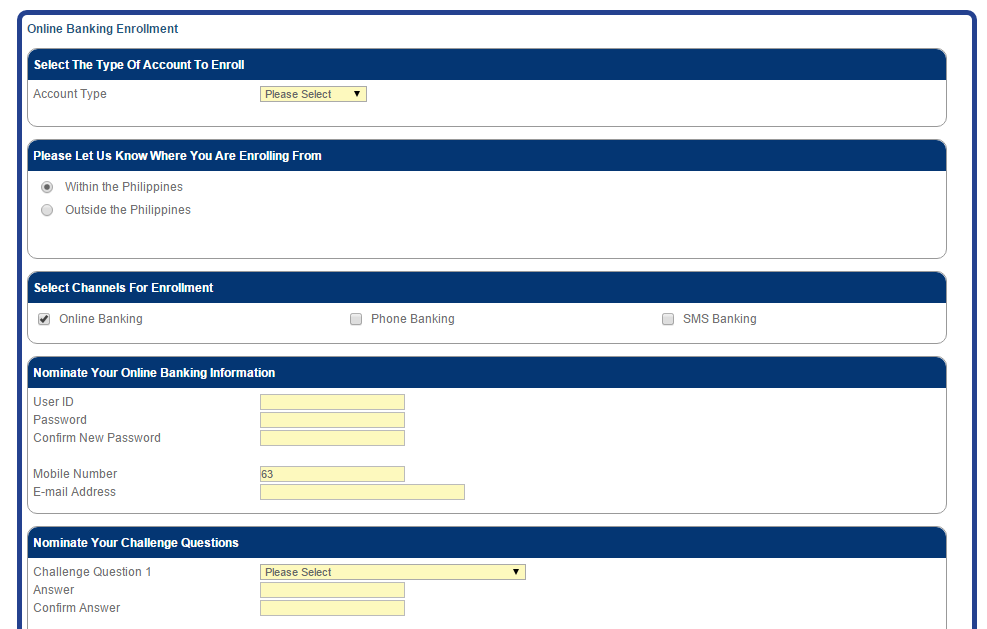

Must i complete documents on the internet in the application procedure?

Yes. You might fill in your write-ups on the internet in our safer americash loans Pinckard webpages: DiscoverHomeLoans/Log on. Entry data online will assist automate the brand new control of your own mortgage consult. All of our safe website in addition to enables you to take a look at your loan updates, check your To complete Record, feedback the new standing away from delivered data files, and much more!

Do i need to generate my costs immediately?

Sure. Among the many documents that is agreed to you in the closure is the function for enrolling in automatic repayments. This type asks for information about the fresh new checking otherwise checking account that you want your own monthly payments become instantly withdrawn of as well as a nullified empty check otherwise savings account put slip. You’ll discover a verification page after you’ve already been effectively subscribed to the automated payment system. You could want to enroll in or terminate automated money at when.

How do i determine how much money I shall need?

It can considerably believe what you’re seeking to funds. If you’re considering a home update endeavor, look work and in case required get estimates regarding you’ll builders. If you are considering a debt negotiation, you can look at previous battery charging comments understand the amount of any a good stability and you will just what interest rates youre already expenses. Many people additionally use money to pay for big expenditures particularly a wedding or a car pick. Scientific studies are a big help right here too, but ensure you take care to imagine all aspects and this will get determine your final expenses.

Eventually, you could contemplate using your property financing proceeds to have multiple purposes. Such as you can use home financing to invest in good do-it-yourself and you may combine your financial situation. Research your facts and make certain you know how the month-to-month money usually fit within your budget.